FAQ

Learn as much as you can about CFDs from our tutorial and other sources. Open a demo account and familiarise yourself with the platform and the working of CFDs. Call us with any questions or to arrange to come in for further training. Once you are happy you can go ahead and click on the open live account option.

1. Click the link on the Open Live Account link to open a live account with IG.

2. Fill in your details and the application form will be provided to you.

3. Complete the application form and attach the required FICA documentation and fax or scan-and-email it back to us. We will check the details and open your account within 1 business day. (You do however need to send us originals within 2 weeks.)

2. Fill in your details and the application form will be provided to you.

3. Complete the application form and attach the required FICA documentation and fax or scan-and-email it back to us. We will check the details and open your account within 1 business day. (You do however need to send us originals within 2 weeks.)

Usually within 2 days after you have supplied all the required documents and proof of funds transfer.

A contract for difference (CFD) is an agreement to exchange the difference in value of a particular instument between the time the contact is opened and the time it is is closed. Coupled with that gearing is offered to allow clients to get much more exposure to the market movement and fees are much lower than traditional equity trading.

The funds required to initiate and maintain an open position. It is not the total amount that can be lost on the trade.

The amount required from a client – in addition to any deposit due – to cover losses when a price moves adversely. Sometimes called ‘variation margin’.

When an account is failing to meet margin requirements. This could require more funds to be deposited into the account or for the margin required in the account to be reduced by closing positions.

As soon as we receive your application and have checked it, we will supply you with the correct details for you to make an electronic transfer of funds. Please note that we cannot accept cash deposits or payments from any other sources. The proof of payment must come from an account in your name. You will also be called upon to deposit additional funds for any margin calls that may occur.

You can at any time send us a request to withdraw funds from your account. We will verify the amount that is available to withdraw and call you to confirm. Funds will then be transferred back into the account details we have on file for you within 2 working days.

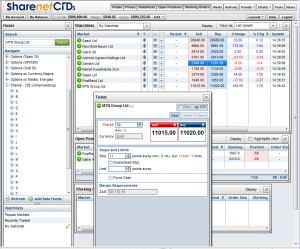

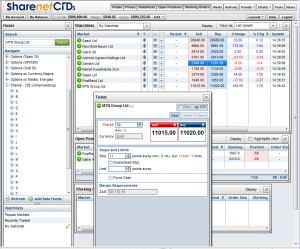

The web based trading system runs in your web browser, but used very modern technologies to ensure a quick and user friendly interface that delivers real-time prices as well.

No software is needed. The system uses very modern web browser technology to provide you with an extremely high quality trading system in your standard web browser. This is is very quick and easy to use from anywhere!

We place the orders directly into the underlying market within a second of you placing them. How quickly they then get filled will depend on the activity in the underling market.

Software will be made available shortly to allow cell phone trading.

Yes you can.

You can presently trade approximately 140 of the most active shares on the JSE and our SATOP40 Index CFD.

The South African Reserve bank does not allow South Africans to transact in forex or any overseas markets without taking money offshore via your foreign currency allowance. We will be facilitating this in the near future.

We have selected shares that have a high liquidity in order to reduce the risk to clients and to ourselves. As a result we only offer shares that have sufficient liquidity in the market that enables one to enter and exit the share timeously. Currently there are +-140 shares that meet the criteria.

CFDs are a leveraged product and can result in losses that exceed your initial deposit. Trading CFDs may not be suitable for everyone, so please ensure that you fully understand the risks involved. All dealings are on an execution only basis. SharenetCFDs does not give advice and any statement made by SharenetCFDs to a client shall not constitute advice or a recommendation to trade or close a trade in any way.

Yes. The dividends will be paid to you the Monday after the LDT date.

You will have to pay the dividend amount in.

The CFD will try to mirror exactly what happens to the underlying instrument.

No, a CFD is not a Future or Single Stock Future (SSF) and has no expiry date. You can hold it until such time as you wish to close your position.

R5000 is the minimum, but we would advise clients to trade with at least R15 000.

Yes, interest is paid on the full cash value of the account, including any profits/losses. The rate is calculated using SABOR less 2%.

You will have to seek advice from your tax advisor as each circumstance is different, however in general as one tends to trade CFDs a lot SARS would see you as a trader and tax you on the profits and not the capital gains.

NEW TO TRADING?

Here at SharenetCFDs we are passionate about educating and empowering. If you are new to the markets or to CFDs as a product, we've got you covered...

ALREADY A TRADER?

SharenetCFDs provide a unique offering, including advanced charting, smart phone applications and 3rd party research, all offered at a competive rate...